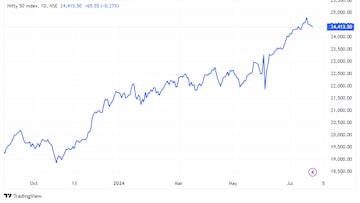

That July series comes to an end on Thursday for the Nifty 50 contracts. The last three days have turned the series for the index from one of handsome gains, to just another normal series. The last three sessions has seen the Nifty correct over 400 points from its record high of 24,854, thereby also cutting down on the gains it made during the series. For the July series, the Nifty is now up just 400 points, from well over 800 points until July 19.

Wednesday’s session also saw the Nifty yet again test 24,300 on the downside and recover from those levels. If we discount the budget day dip as a one-off, Wednesday’s low for the Nifty at 24,308 was lower than Monday’s low of 24,362. The index has now declined for four straight sessions and is slowly grinding lower, indicating the possibility of a price and time-wise correction.Despite the benchmark indices facing selling pressure, the broader markets have been in a league of their own. The Nifty Midcap index gained a percent, the Smallcap index did one better, gaining nearly 2% on Wednesday. Earnings reactions were aplenty as were reactions or continuations to Budget day reactions.

Shares of shrimp feed companies like Avanti Feeds, Waterbase, Apex Frozen foods surged up to 20%, while Kaveri Seed built on its Budget-day gains. Thyrocare had a strong day post results, while PSU stocks saw a rebound post a brief sell-off on Tuesday.

Thursday’s trading session will see stocks like L&T, Axis Bank, SBI Life, JSPL, Sona BLW, IEX, DCB Bank, Karnataka Bank and others react to their quarterly results. Nestle India, Canara Bank, Adani Green Energy, Adani Energy Solutions, Laurus Labs, MGL, Ramco Cements, Ujjivan SFB, VST Industries and others will be reporting their June quarter results on Thursday as well.

There seems to be more stock specific interest in the market while the Nifty is going through the corrective phase, said Ruchit Jain of 5paisa.com, adding that the RSI oscillator on the Nifty is hinting at a continuation of the corrective phase. Immediate downside support is at 24,200, followed by 24,000, while 24,700 – 24,800 remains the resistance zone.

Rajesh Bhosale of Angel One expects the Nifty to continue trading in a range on its expiry session. 24,300 – 24,250 zone remains a key support from the index, and a slip below which can push the index back to its budget-day low of 24,074. On the upside, 24,600 remains an immediate hurdle, followed by 24,850.

The formation of a bullish hammer pattern and the high wave in two consecutive sessions could signal a temporary halt to the downside momentum, said Nagaraj Shetti of HDFC Securities. Further weakness from here could find support between 24,270 and 24,100, while 24,580 is an immediate hurdle and crossing that could confirm a near-term bottom reversal pattern.

The Nifty Bank has been the actual pain point for the Nifty over the last few trading sessions. Since hitting a record high of 53,357 on July 4, the index has corrected over 2,000 points from those levels, led mainly by HDFC Bank. Even on Wednesday, the top three Nifty contributors to the downside were HDFC Bank, Axis Bank and SBI. As we highlighted earlier, had it not been for the 600-point recovery from the lows of the day for the Nifty Bank, the correction on the Nifty could’ve been much deeper. You can read more about the road ahead for the index here.

The Nifty Bank remains below its short-term consolidation breakdown and the sentiment may remain weak as it has closed below its key support level of 51,700 and its 21-Day exponential moving average, said Rupak De of LKP Securities. He advises using a sell-on-rise approach till the index closes above the mark of 52,000. Immediate downside support is now at 50,900, while 51,500 and 52,000 will act as barriers.

Hrishikesh Yedve of Asit C Mehta Investment Interrmediates said that the Nifty Bank on the daily scale has retested its previous breakout from the rounding bottom pattern and closed above it and also supported its 50-DMA support near 50,950. He added that a short-term relief rally cannot be ruled out till the index sustains 51,000 – 50,950 on the downside. A slip below 50,950 though will trigger fresh weakness for the Nifty Bank.

What Are The F&O Cues Indicating?

Short covering was seen in these stocks on Wednesday, meaning an increase in price but a decline in Open Interest:

| Stock | Price Change | OI Change |

| Crompton | 2.64% | -74.48% |

| United Spirits | 4.86% | -71.16% |

| Manappuram Finance | 3.54% | -68.34% |

| Jubilant Foodworks | 3.29% | -67.92% |

| Petronet LNG | 3.88% | -67.33% |

Unwinding of long positions was seen in these stocks on Wednesday, meaning a decline in both price and Open Interest:

| Stock | Price Change | OI Change |

| Bandhan Bank | -4.03% | -66.93% |

| Dabur | -3.15% | -66.69% |

| GCPL | -3.87% | -63.89% |

| Bajaj Finserv | -2.21% | -61.82% |

| Mphasis | -3.26% | -55.52% |

These are the stocks to watch out for ahead of Thursday’s trading session:

- L&T: Net profit of ₹2,785.7 crore, slightly lower than CNBC-TV18 poll of ₹2,873 crore. Revenue of ₹55,119 crore, higher than poll of ₹51,957 crore. EBITDA at ₹5,615 crore, higher than ₹5,480 crore estimate. Margin at 10.2% below poll of 10.5%. Management tells CNBC-TV18 that it will not be revising its revenue and order inflow guidance for financial year 2025. It continues to expects a 20 basis points improvement in core margins on a year-on-year basis. L&T has an order book of ₹4,000 crore in the thermal power project and has decided to transition to clean energy.

- Axis Bank: Net profit of ₹6,035 crore, higher than poll of ₹5,776.4 crore. Net Interest Income of ₹13,448 crore, in-line with estimates of ₹13,353 crore. Gross NPA at 1.54% from 1.43% in March. Net NPA at 0.34% from 0.31% in March. Provisions rise to ₹2,039 crore from ₹1,185 crore in March.

- JSPL: Net profit of ₹1,337.9 crore, higher than CNBC-TV18 poll of ₹1,245 crore. Revenue of ₹13,617 crore, also higher than poll of ₹13,050 crore. EBITDA at ₹2,839.2 crore beats estimate of ₹2,620 crore. EBITDA margin at 20.9% versus estimate of 20.1%. Volumes at 2.09 MT versus poll of 2 MT. EBITDA per tonne at ₹12,890 from ₹12,443 in March. Net debt down to ₹10,462 crore from ₹11,203 crore in March.

- IEX: Net profit up 27.2% to ₹96.4 crore. Revenue up 18.8% to ₹123.6 crore. EBITDA up 22% to 99.4 crore. EBITDA margin at 80.4% from 78.4% last year.

- JK Paper: Net profit down 54.8% to ₹139.7 crore. Revenue up 8.2% to ₹1,713.7 crore. EBITDA down 41.3% to ₹280.4 crore. EBITDA margin at 16.4% from 30.1% last year. Results have been adversely impacted due to a significant drop in market prices coupled with a surge in wood cost compared to the corresponding quarter. Increased sales volume through higher utilisation in the packaging board business.

- Indraprastha Gas: Net profit of ₹401 crore, in-line with estimate of ₹389 crore. Revenue of ₹3,520 crore, higher than poll of ₹3,494 crore. EBITDA of ₹582 crore also higher than poll of ₹541 crore. EBITDA margin at 16.5% is 100 basis points higher than the poll of 15.5%.

- MAS Financial Services: Disbursals up 18.9% year-on-year to ₹2,775 crore. AUM up 23.3% to ₹10,384 crore. Net Interest Income up 31% to ₹154.1 crore. Net profit up 24.8% from last year to ₹71.5 crore. Gross NPA at 2.29% from 2.25%. Net NPA at 1.5% from 1.51% in March. Provisions up 27.1% from last year and 11.8% from March to ₹23.94 crore. Calculated NIM at 5.94% from 5.59% last year.

- DCB Bank: Net Interest Income up 5.5% from last year to ₹496.6 crore. Net profit up 3.5% year-on-year to ₹131.4 crore. Gross NPA at 3.33% from 3.23% sequentially. Net NPA at 1.18% from 1.11% quarter-on-quarter. Slippages up 15.5% from March to ₹373 crore. Provisions down to ₹28.4 crore but up 17.9% sequentially. RoA down to 0.82% from 0.94% last year and 1.02% in March.

- RBL Bank: Sources tell CNBC-TV18 that Maple II BV is likely to sell its entire 7.9% stake via block deals. The floor price of ₹226 per share is a 5% discount to Wednesday’s closing price. The offer size is said to be worth ₹1,081.2 crore.

#Trade #Setup #July #Nifty #begun #price #time #correction